Tom Reilly, president of VMI Sports, walks through a decade of building a bootstrapped supplement brand — from Lone Star Distribution house brand to grocery chains, the PEZ collab, and two mystery canned beverages on the horizon, on Episode #205 of the PricePlow Podcast.

Tom Reilly, president of VMI Sports, brings a perspective from all over the industry, and he’s got a lot of educational things to say. Two decades spent at GNC, then in natural food distribution at UNFI, and eventually as a purchasing director and director at Lone Star Distribution gave him an unusually complete map of how supplements actually move through the market. VMI grew out of that experience, launched as a house brand for Lone Star in 2012 before Tom took it full time in late 2015, and has been grinding ever since — bootstrapped, profitable, and growing every single year.

In Episode #205 of the PricePlow Podcast, Mike and Ben sit down with Tom to cover the full arc: how VMI got started, what distribution taught him that brand founders usually learn the hard way, the evolution from specialty sports nutrition into grocery chains, the K-XR pre-workout legacy, the PEZ collaboration strategy, and some genuinely exciting teases for what’s coming in 2026, including two canned beverages that are neither energy drinks nor protein sodas.

This is a good one, and Tom’s willingness to mentor others shines through, as we learned a lot in this one – and we guarantee you will too.

Subscribe to the PricePlow Podcast on your favorite platform and sign up for VMI Sports news alerts before diving in — you won’t want to miss those can reveals when they drop.

0:00 – Introductions

Ben kicks things off welcoming Tom Reilly, president of VMI Sports, back into the PricePlow orbit. Tom notes a bit of history as the guys have known each other for a while, seeing each other throughout industry events. The setup gives the episode an easy, familiar dynamic as the guys prepare to go deep on Tom’s background, VMI’s growth, and where the brand is headed.

0:30 – Tom’s Background: GNC, UNFI, and Lone Star

Tom’s career reads like a tour through every layer of the supplement supply chain. He started at GNC in college, caught the bug for the industry, and transitioned into distribution — first at UNFI on the natural food side, then over to Lone Star Distribution, a sports nutrition-focused distributor that was becoming the number two national distributor in the country when he joined around 2008-2009.

At Lone Star, Tom did it all: e-commerce accounts, FDM and grocery buyers, and eventually purchasing, where he interfaced with brands daily. That span of experience at retail, then natural distribution, then specialty sports nutrition distribution ultimately gave him a perspective that most brand founders simply don’t have when they start.

3:00 – Building VMI from Within Lone Star

Tom puts some dates to the VMI story, and they matter. Lone Star formally made VMI an entity in 2012, launching simple products in 2013. But for a few years it was almost an afterthought. As a house brand with no dedicated employees, there to simply fill category gaps and carry higher margins for the distributor. Tom was running it as a passion project on the side while still serving as purchasing director.

By 2014-2015, as Lone Star moved toward a private equity exit, VMI had started developing some real traction. When the equity group acquired Lone Star in 2015 and wanted all the directors to stay on, Tom made a calculated choice: he stayed as a transitional consultant for a short window, then exited to run VMI full time. His wife was pregnant. It was objectively terrible timing. He did it anyway… and it worked.

7:45 – Going Full Time: The 2015 Pivot

The early VMI days outside of Lone Star were a grind. Lone Star remained the exclusive distributor per the original agreement, which meant Tom had to be careful not to damage the partnership while also trying to grow independently. He describes a phase of stumbling, getting his feet wet, and learning quickly how different running a brand is from working with brands.

Outside of Lone Star’s existing customer base, essentially no one had heard of VMI. Tom’s honest about the learning curve: knowing what mistakes to avoid from the distribution side didn’t mean he was immune to making his own. The company has now grown every year for a decade, even in 2020 and through market shifts, bootstrapped and profitable throughout.

10:30 – Business Wisdom from Distribution

Tom’s most passionate moments come when he talks about what brands get wrong coming into the market, and why his distribution background gave VMI a rare advantage. Scan-down allowances, trade spend, show commitments, off-invoice discounts… these are things a lot of founders learn about only after signing contracts they don’t fully understand.

VMI Sports expands their PEZ Candy collaboration with L-Carnitine 3000 and L-Carnitine 1500 Heat. Pure metabolic support vs thermogenic fat burning, both in PEZ Grape and Cherry. Because carnitine doesn’t need to taste clinical.

He’s emphatic that blaming distributors or retailers for these costs is misplaced. “If you signed on to that deal, pay the deal.” His broader point is about balance: yes, distributors and retailers are going to negotiate hard, but so are brands when dealing with their manufacturers. The entire supply chain works the same way, and founders who understand that dynamic going in make smarter decisions across the board.

13:00 – Consumer Education and Supply Chain Reality

The conversation touches on a social media trend from a few years back, when some accounts started publishing contract manufacturer pricing to argue that pre-workouts were overpriced. The team walks through the math: an $8 cost of goods doesn’t include labels, neckbands, inbound and outbound freight, warehousing, scanning systems, retail fees, and payroll for all of the people involved in getting that bottle onto a shelf.

Tom draws the comparison to any other consumer product. A premium smartphone doesn’t cost its retail price to manufacture either. For him, the more important issue is that consumer education is better than it’s ever been (he graciously credits PricePlow and the broader internet for that), but there’s still a gap, because new customers are entering the supplement space faster than anyone can educate them. That’s just the reality of a growing category.

18:00 – Vision Meets Innovation: The VMI Name

Mike asks the natural question: what does VMI actually stand for? Tom’s answer is “Vision Meets Innovation”, and he takes a moment to explain what he means by innovation, because for him it’s never meant chasing exotic or mythological ingredients. His target has always been balance: well-rounded formulas that deliver real results and that people genuinely want to consume again.

He uses an analogy that stuck with him from conversations with Natural Body Inc’s Tim Gritzman: grandma’s Sunday sauce isn’t famous for some rare herb from another country. It’s famous because everything is in the right proportion. That’s the lens Tom applies to VMI’s product development. Something that works, tastes good, and keeps people coming back… that’s the actual innovation he cares about.

23:15 – K-XR: Origins and the Miami Vice Flavor

Mike brings up the original K-XR pre-workout formula and one of PricePlow’s early flavor memories: Miami Vice. Tom traces that flavor back to his honeymoon in Cabo, courtesy of Kyung of Redefined Nutrition (then running FinaFlex), who let Tom and his wife stay there. They had a Miami Vice cocktail — strawberry, pina colada, pineapple — and Tom came back determined to turn it into a supplement flavor.

He half-jokes that Scott Furman of Formulife might also claim credit for inventing Miami Vice as a supplement flavor, but VMI was certainly early. The broader point is that unique flavors weren’t common at the time; fruit punch, blue razz, and orange were the safe plays. Miami Vice was a swing at something different, and it landed.

25:00 – K-XR: Three Caffeines, Grocery, and the High-Stim Formula That Works

Tom holds up the K-XR on camera, as they’d just received the latest run the day before recording. The formula uses three distinct caffeine sources (caffeine citrate, anhydrous, and Infinergy dicaffeine malate) with different onset profiles, plus beta-alanine, theobromine, and alpha-yohimbine. It’s a proper high-stim formula, and Tom is direct about that.

VMI also recently launched OG K-XR under their PEZ collaboration, carrying PEZ Sours flavors on the same core formula. Tom points out that K-XR’s presence in grocery chains surprises some people given how strong it is. His family has been in the grocery business for three generations, so the channel is instinctive for him, and the formula genuinely moves there.

30:15 – Winning on the Grocery Shelf

Tom spends real time on what it actually takes to succeed in grocery retail, and the picture he paints is different from what most brands assume. Grocery is not destination shopping, it’s ancillary. Someone going to a GNC is going there for supplements. Someone walking through a grocery store is grabbing beef jerky, a protein bar, and maybe a pre-workout, all in the same aisle.

That changes what matters: packaging callouts, color, font, flavor name clarity, package sizing appropriate to the category. He’s watched plenty of DTC (Direct-to-Consumer) brands that do excellent numbers on their websites walk into the grocery world with the same packaging and fail because the shelf requires a completely different conversation. VMI built for that context, and Tom credits their designer Dre with a lot of the recent success in getting the shelf presence right.

33:30 – Packaging Evolution and the PEZ Aesthetic

Ben brings up the contrast between early VMI packaging and what they’re doing now with the PEZ collab. The older stuff reflected the distribution era: hardcore, sports nutrition-forward. The PEZ collab packaging with bright fruit-like colors and approachable fonts is something, as Ben puts it, his mom would pick up. And it still kicks you in the pants.

Tom frames the shift as deliberate and necessary. As VMI moved into larger chains and sporting goods retail, the brand had to update to accommodate those retailers and their shoppers. The driving principle became “update to accommodate”, whether packaging, neckband design, or flavor names. Dre has been the person making that happen, building a visual identity that bridges specialty-formula seriousness with consumer-facing fun.

36:00 – More on the PEZ Collaboration

Tom explains the full licensing process. VMI hired an agency run by someone they trusted, reviewed more than 40 to 50 potential license agreements over time, and were deliberate about turning most of them down. The criteria were whether they could move fast, get initial retail placement, and then expand the partnership, but not just drop one SKU and move on.

When Glaxon’s license became available and PEZ emerged as an option, the fit was clear: PEZ had existing industry recognition and a wide enough flavor catalog to work across VMI’s product range, but they needed a reliable, further-along brand partner.

Tom told them VMI had no other active licenses at the time, and that was a selling point, because it meant PEZ would get full attention. They went wide immediately, covering carnitine, pre-workout, pump product, and K-XR across different PEZ and PEZ Sours flavors rather than repeating the same cherry-orange-grape pattern on every SKU. Tom credits Simpson Labs as their primary manufacturing partner through the PEZ rollout, saying that partnership was essential to getting products out both quickly and correctly.

41:15 – Pump & Flow: The Sleeper Hit with Hydronox

Tom’s pick for the most underappreciated product in the VMI lineup is Pump & Flow, a glycerol liquid they built as a stim-free pre-workout option. Half a cap stacks with any pre-workout; a full cap works as a standalone for late-night or caffeine-free training. GNC franchise locations, which Tom describes as among the best specialty retail partners they work with, have been doing very well with it.

The formula uses HydroNOx (citrulline hydrochloride), and Tom notes that VMI was the first brand to use the ingredient in a liquid format. This is the kind of move that fits the VMI pattern: not the loudest ingredient story, but a genuine formulation choice that offers something different from what everyone else is doing. Two PEZ flavors are currently available on Pump & Flow (PEZ Sour Green Apple and PEZ Cherry), and the product continues to be one of their fastest-growing SKUs.

44:00 – Protolyte: Ahead of the Hydration Curve

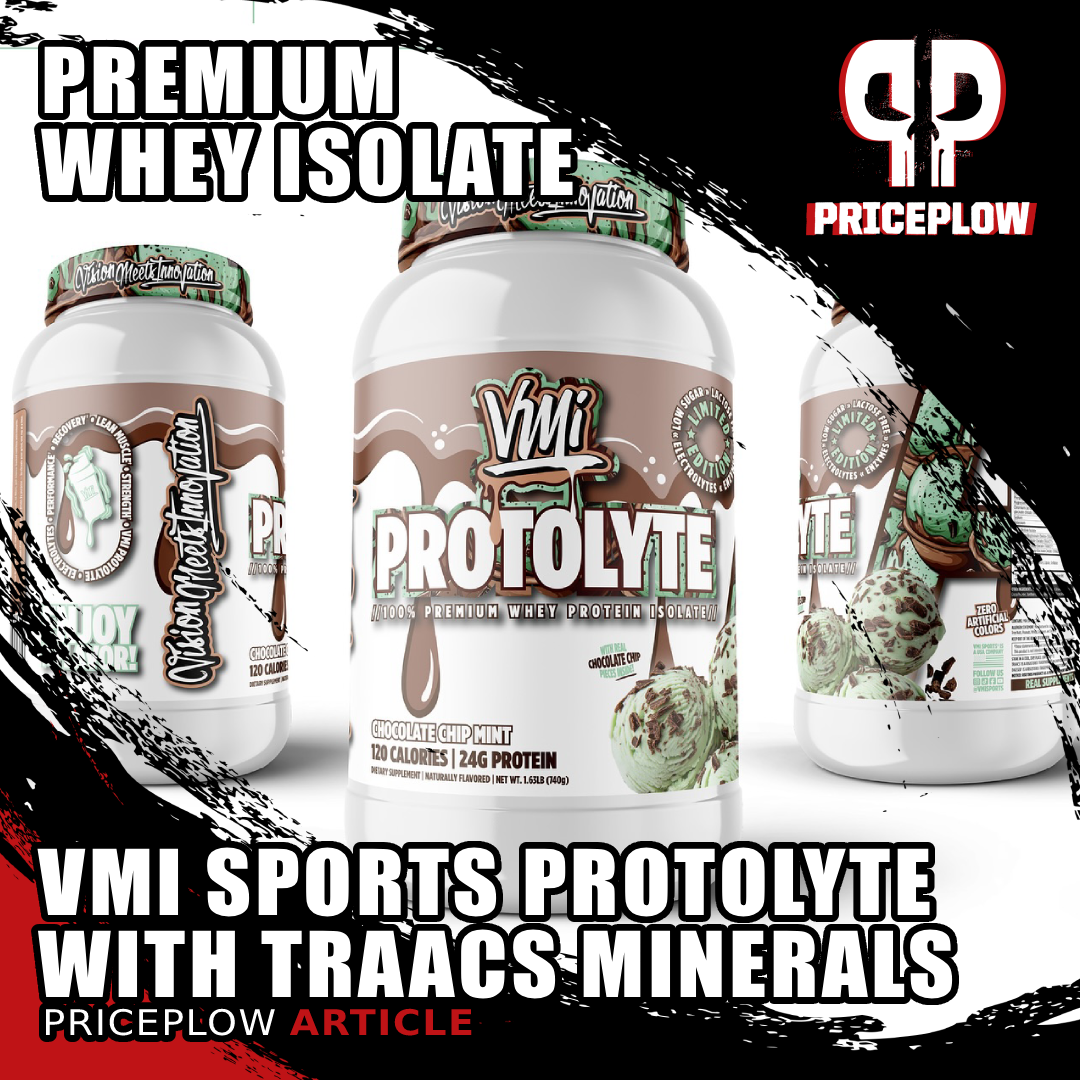

Mike brings up Protolyte, VMI’s whey isolate protein, and gives Tom some deserved recognition: VMI was using TRAACS-chelated Albion minerals in Protolyte before the industry-wide hydration conversation really started. Pure whey isolate strips calcium during processing; VMI added high-quality calcium and other minerals back in, alongside digestive enzymes, to make the formula both more bioavailable and more gut-friendly.

VMI Sports Protolyte isn’t just another whey isolate. 24g protein with TRAACS chelated minerals that actually absorb, digestive enzymes to prevent bloat, and flavors with real freeze-dried ingredients. They’ve been ahead of the curve since 2019.

Tom is characteristically understated about it. He remembers calling tRick Harnish at Albion (now owned by Balchem) to discuss the mineral inclusion. The reaction was essentially “you’re doing what?”, but the decision was grounded in what made the product better for the user, not what would make for a good press release. He makes the same point about digestive enzymes: VMI was using it in Protolyte before it became a standard inclusion category. The brand has a recurring pattern of being early to functional ingredients without making the timing part of the pitch.

47:30 – Acquisition, Retention, and Brand Philosophy

Tom draws a candid line between what VMI did well for a long time and what they struggled with. Retention was never a problem. If someone tried a VMI product, they came back — the product quality, taste, and accuracy of the label made sure of that. Acquisition was the grind. The branding and marketing never fully told the story of what was inside the bottle.

He uses Ghost and C4/Cellucor as benchmarks he genuinely respects: not just as marketing machines, but as brands that back their presentation with formulas that are actually excellent. VMI’s mission over the past two years has been catching up on that acquisition side while maintaining the retention foundation that kept them alive long enough to do so. Their website retention rate is well above industry average, which Tom cites as proof the product has always done its job.

52:00 – Staying Independent: VMI’s Long Game

The trio circles back to Tom’s earlier comments about private equity conversations. VMI has fielded offers. Tom and his business partner Frank Fenimore have passed. The reasoning isn’t ideological… it’s just that they still have unfinished business. Categories they want to enter. Retail accounts they want to win. Tom can’t imagine the right exit scenario happening before those things are done.

He also makes a practical point: when you’re profitable, love what you do, and have a team you believe in, the math on staying independent is different than it looks from the outside. The freedom to make your own decisions, such as which products to make, which channels to enter, and which collabs to pursue, is worth quite a bit. VMI’s path has been slower and harder, but it’s theirs. As Tom puts it: he has unfinished business, and he’s not done.

54:30 – Two Canned Beverages Coming in 2026

Here’s the tease of the episode: VMI has two canned beverages in development, both approximately 90% done as of recording. Neither is an energy drink. Neither is a protein soda. Tom won’t say much more than that, except that at least one of them will be “very industry unique and special”, one of them may have a new collab announcement tied to it, and PEZ will be involved with some of the beverage rollout.

At least one of the cans will launch in two major retail chains on day one. Tom credits a manufacturing partner and a top-tier R&D division (both unnamed) with making the projects possible. VMI already sells the KXR RTD and has operated in the ready-to-drink space, so this isn’t a category they’re walking into cold, but cans are a different production challenge, and the team has been working it carefully. The goal is Q2 2026.

57:30 – K-XR RTD and the Beverage Category Landscape

With the can tease still fresh, Mike and Tom talk through the existing K-XR RTD, which Tom describes as arguably the most formula-dense product in the VMI lineup: glycerol, citrulline, taurine, and the same three-caffeine system from the powder. It’s the strongest RTD in most gym coolers they’re in, and Tom owns that positioning. Crunch Fitness franchise locations do very well with it, including with female customers who sometimes take half the bottle and reseal it.

Tom also reflects on the broader history of RTD beverages in the supplement space: brands like ABB, MET-Rx Worldwide, and Twinlab used to fill coolers with numerous options. That variety has shrunk over time. He cites Glanbia shutting down ABB despite it doing $10-15 million in annual revenue because the margins weren’t worth the operational complexity at their scale. For a brand like VMI, that same category has room, especially if you know how to distribute it, which Tom does.

1:01:30 – Distribution Realities of Canned Beverage

Tom and Ben unpack the hidden costs of beverage distribution that trap a lot of brands. You’re essentially shipping heavy water with a clock on it: beverages have expiration dates, they take up more space, they’re more prone to damage in transit, and slotting refrigerated space in retail carries premium fees most founders don’t budget for. Tom notes that damage rates on cans are higher than dry goods, and that all of this has to be modeled before you ever put in a first production order.

The saving grace in today’s market, he argues, is that consumers are willing to pay more for immediate-consumption products than they used to be. Premium RTD products regularly sell for over $5 at the C-store level. That gives brands a bit more room to absorb the costs… assuming they’ve planned for them. VMI’s existing beverage infrastructure and distribution relationships make it a more manageable jump than it would be for a brand entering canned beverage from zero.

1:05:00 – Wrap-Up and What’s Next

Tom wraps up with some reflection on PricePlow’s role in the industry and what he hopes listeners take from the episode. His through line for the whole conversation: the supplement industry rewards people who understand how all parts of the supply chain work together, who don’t blame partners for hard terms they agreed to, and who build products they’d actually consume. VMI has tried to operate that way for a decade.

He also shows off the custom Perfect Shaker VMI Sports shaker he received right before recording (a first-ever VMI-branded version!) and makes clear it’s going on the memorabilia shelf in his office, not in the gym bag. He invites Ben up to the new Long Island office and recording studio whenever those canned beverage launches are ready to announce. Plans are in motion.

Big thanks to Tom for sitting down with us and walking through the full VMI Sports story! From a house brand at Lone Star to a decade of independent, profitable growth and some genuinely exciting things coming in 2026. We’ll be watching for those can announcements closely.

This episode is brought to you by Perfect Shaker — thanks a ton for the custom VMI Sports shaker that’s now going straight to the display shelf. You can grab your own incredible shaker cup at PricePlow.com/perfect-shaker.

Add comment